It's long, it's complicated, and Marjorie Taylor Greene (and probably most people she works with) hasn't read it. Let's not be one of those people. Here is a simplified version of a very complex, and very dangerous bill, that's easy to read and something we can all understand. Please share with friends and family. Thank you.

TITLE XI -- COMMITTEE ON WAYS AND MEANS, "THE ONE, BIG, BEAUTIFUL BILL"

111201 - EXPANDING THE DEFINITION OF RURAL EMERGENCY HOSPITAL UNDER THE MEDICARE PROGRAM

Section 1861 of the Social Security Act is amended so that rural hospitals that have closed between 2014-2020 may reopen under Rural Emergency Hospital (REH) designation (i.e. small facilities that provide emergency and observation services, but no in-patient beds). However, the distance between an REH and local area hospital can limit eligibility for increased outpatient payments, and facilities will likely have to invest in more transfer services for sicker patients.

PART 1 - WORKING FAMILIES OVER ELITES

112001 - TERMINATION OF PREVIOUSLY-OWNED CLEAN VEHICLE CREDIT

Section 25 of the Internal Revenue Code of 1986 is amended to accelerate the expiration date for tax credits for previously-owned clean vehicles, which was either $4000 or 30% of the sale price of the vehicle. It was originally set to expire December 31, 2032, and will now expire in 2025.

112002 - TERMINATION OF THE CLEAN VEHICLE CREDIT

Section 30 is amended to accelerate the expiration date for tax credits for new clean vehicles, which was $7,500. It was originally set to expire December, 2032, and will now expire in 2025.

112003 - TERMINATION OF QUALIFIED COMMERCIAL CLEAN VEHICLES CREDIT

Section 45 is amended to accelerate the expiration date for tax credits for commercial clean vehicles, which was $7,500. It was originally set to expire December 31, 2032, and will now expire in 2025.

112004 - TERMINATION OF ALTERNATIVE FUEL VEHICLE REFUELING PROPERTY CREDIT

Section 30 is further amended to accelerate the expiration date for tax credits for refueling properties, which was 30% of the property. It was originally set to expire December 31, 2032, and will now expire in 2025.

112005 - TERMINATION OF ENERGY EFFICIENT HOME IMPROVEMENT CREDITS

Section 25 is further amended to accelerate the expiration date for tax credits for energy efficiency improvements (upgrading insulation, installing energy-efficient appliances, using smart thermostats), which was 30% of qualified improvements. It was originally set to expire December 31, 2032, and will now expire in 2025.

112006 - TERMINATION OF RESIDENTIAL CLEAN ENERGY CREDIT

Section 25 is further amended to accelerate the expiration date for tax credits for homeowner spending (solar electric, solar water, fuel cells, wind energy), which was 30% of expenditures. It was originally set to expire December 31, 2032, and will now expire in 2025.

112007 - TERMINATION OF NEW ENERGY EFFICIENT HOME CREDIT

Section 45 is further amended to accelerate the expiration date for tax credits for Energy Star homes considered "Zero Energy Ready" (renewable energy systems offset energy consumption), which was $5000. It was originally set to expire December 31, 2032, and will now expire in 2025.

112008 - PHASE-OUT AND RESTRICTIONS ON CLEAN ELECTRICITY PRODUCTION CREDIT

Section 45 is further amended to phase out the clean electricity production credit, which rewarded taxpayers who produce electricity from facilities determined to have greenhouse gas emissions less than zero. This program will be gone by 2031.

112009 - RESTRICTIONS ON CLEAN ELECTRICY INVESTMENT CREDIT

Section 48 is amended to phase out tax credits for investing in clean electricity and energy storage from facilities determined to have greenhouse gas emissions less than zero. This program will be gone by 2031.

112010 - REPEAL OF TRANSFERABILITY OF CLEAN FUEL PRODUCTION CREDIT

Section 6418 is amended so that a taxpayer may not transfer tax credits for clean fuel production to another person.

112011 - RESTRICTIONS ON CARBON OXIDE SEQUESTRATION CREDIT

Section 45 is further amended to repeal tax credits for capturing and disposing of carbon oxide (CO or CO2), which were up to $36 per metric ton and set to increase after 2026. No credit will be given after the enactment of this bill.

112012 - RESTRICTIONS ON ZERO-EMISSION NUCLEAR POWER PRODUCTION CREDIT

Section 45 is further amended to accelerate the expiration date for tax credits for electricity produced by nuclear power plants. It was originally set to expire December 31, 2032, and will now expire in 2025.

112013 - TERMINATION OF CLEAN HYDROGEN PRODUCTION CREDIT

Section 45 is further amended to accelerate the expiration date for tax credits for qualified clean hydrogen. It was originally set to expire January 1, 2033, and will now expire in 2025.

112014 - PHASE-OUT AND RESTRICTIONS ON ADVANCED MANUFACTURING PRODUCTION CREDIT

Section 45 is further amended to accelerate the expiration date for tax credits for inverters, solar and wind energy components, battery components, and critical minerals. It was originally set to expire December 31, 2032, and will now expire in 2027 for wind, and 2031 for all other components.

112015 - PHASE-OUT OF CREDIT FOR CERTAIN ENERGY PROPERTY

Section 48 is further amended to accelerate the expiration date for tax credits for geothermal heat pumps. It was originally set to expire January 1, 2035, and will now expire in 2031.

112016 - INCOME FROM HYDROGEN STORAGE, CARBON CAPTURE ADDED TO QUALIFYING INCOME OF CERTAIN PUBLICLY TRADED PARTNERSHIPS TREATED AS CORPORATIONS

Section 7704 is amended to expand what is considered "qualifying income" for publicly-traded partnerships (where shares can be bought and sold), including storage of liquid or compressed hydrogen and carbon-dioxide capture.

112017 - LIMITATION ON AMORITIZATION OF CERTAIN SPORTS FRANCHISES

Section 197 is amended to reduce amortization (paying off debt) deductions for sports-related intangibles (goodwill, franchise value, employment contracts, etc.) to 50% of the current deduction.

112018 - LIMITATION ON INDIVIDUAL DEDUCTIONS FOR CERTAIN STATE AND LOCAL TAXES, ETC.

Section 275 is amended to increase the State and Local Tax (SALT) cap--which allows taxpayers to itemize deductions for state and local taxes up to $10,000, and was set to expire in 2025--to $30,000 and will extend it permanently.

112019 - EXCESSIVE EMPLOYEE REMUNERATION FROM CONTROLLED GROUP MEMBERS AND ALLOCATION OF DEDUCTION

Section 162 is amended to add limitations to a highly-paid employee's (CEO, CFO, COO, etc.) ability to deduct his or her compensation.

112020 - EXPANDING APPLICATION OF TAX ON EXCESS COMPENSATION WITHIN TAX-EXEMPT ORGANIZATIONS

Section 4960 is amended to omit former highly-paid employees (up to $1 million/year) from excise tax on excess compensation, and include only current employees.

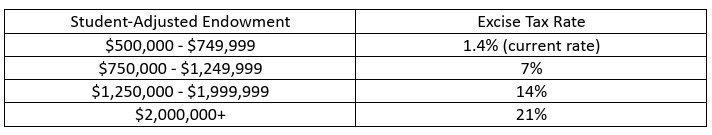

112021 - MODIFICATION OF EXCISE TAX ON INVESTMENT INCOME OF CERTAIN PRIVATE COLLEGES AND UNIVERSITIES

Section 4968 is amended to increase the current 1.4% excise tax imposed on educational institutions for investment income to the following tiered system:

112022 - INCREASE IN RATE OF TAX ON NET INVESTMENT INCOME OF CERTAIN PRIVATE FOUNDATIONS

Section 4940 is amended to increase the current 1.39% excise tax imposed on private foundations for investment income to the following tiered system:

112023 - CERTAIN PURCHASES OF EMPLOYEE-OWNED STOCK DISREGARDED FOR PURPOSES OF FOUNDATION TAX ON EXCESS BUSINESS HOLDINGS

Section 4943 is amended to state that any stocks repurchased by a company from a previous employee are considered "outstanding" (currently owned by shareholders), and should be included in the 20% limitation on voting stock (number of employees allowed to own stock in a company).

112024 - UNRELATED BUSINESS TAXABLE INCOME INCREASED BY AMOUNT OF CERTAIN FRINGE BENEFIT EXPENSES FOR WHICH DEDUCTION IS DISALLOWED

Section 512 is amended to include employee transportation benefits (transit pass, vanpooling, parking, etc.) in taxable income. This was previously not included.

112025 - NAME AND LOGO ROYALTIES TREATED AS UNRELATED BUSINESS TAXABLE INCOME

Section 512 is further amended to include the sale or licensing of a company logo in taxable income. This was previously not included.

112026 - EXCLUSION OF RESEARCH INCOME LIMITED TO PUBLICLY AVAILABLE RESEARCH

Section 512 is further amended to include any non-profit research freely available to the public, including income from private research, to be included in taxable income. This was previously not included.

112027 - LIMITATION ON EXCESS BUSINESS LOSSES OF NONCORPORATE TAXPAYERS

This sections makes the previous provision that allowed for no deductions for excess business loss (amount your deductibles exceed your gross income) permanent.

112028 - 1-PERCENT FLOOR ON DEDUCTION OF CHARITABLE CONTRIBUTIONS MADE BY CORPORATIONS

Section 170 is amended to reduce the amount of taxable income a company can deduct for charitable contributions from 10% to 1%.

112029 - ENFORCEMENT OF REMEDIES AGAINST UNFAIR FOREIGN TAXES

This section defines the U.S. government's response to "unfair taxes" imposed by a foreign government, as determined by the Secretary of Treasury (currently Scott Bessent), and will raise taxes on those governments and entities in response.

112030 - REDUCTION OF EXCISE TAX ON FIREARMS SILENCERS

Section 5845 is amended to remove the transfer tax (ownership from one individual to another) on firearm silencers.

112031 - MODIFICATIONS TO DE MINIMIS ENTRY PRIVILEGE FOR COMMERCIAL SHIPMENTS

Section 321 of the Tariff Act of 1930 is amended to remove the standard of products valued at under $800 entering the U.S. duty-free, and instead will increase penalties for violators.

112032 - LIMITATION ON DRAWBACK OF TAXES PAID WITH RESPECT TO SUBSTITUTED MERCHANDISE

This section states that you cannot claim a refund for excise (goods, services, or activities) tax on imported tobacco unless the excise tax was actually paid on exported goods.

If you would like to read the bill yourself, click the link below.

The Big, Beautiful Bill

Ellie is an author, editor, and owner of Red Pencil Transcripts, and works with filmmakers, podcasts, and journalists all over the world. She lives with her family just outside of New York City.

Thank you for posting this.

Thank you again Ellie. It’s hard to read what they’re going to do to all but the 1% but we need to know and be able to share it in an understandable form. Not that MAGA wants facts but I’ll shave them in their face anyway. I appreciate your hard work.