It's long, it's complicated, and Marjorie Taylor Greene (and probably most people she works with) hasn't read it. Let's not be one of those people. Here is a simplified version of a very complex, and very dangerous bill, that's easy to read and something we can all understand. Please share with friends and family. Thank you.

TITLE IX -- COMMITTEE ON WAYS AND MEANS, "THE ONE, BIG, BEAUTIFUL BILL"

110000 - REFERENCES TO THE INTERNAL REVENUE CODE OF 1986, ETC.

Any discussion of amendments or repeals are in reference to the Internal Revenue Code of 1986.

PART 1 - PERMANENTLY PREVENTING TAX HIKES ON AMERICAN FAMILIES AND WORKERS

110001 - EXTENSION OF MODIFICATION RATES

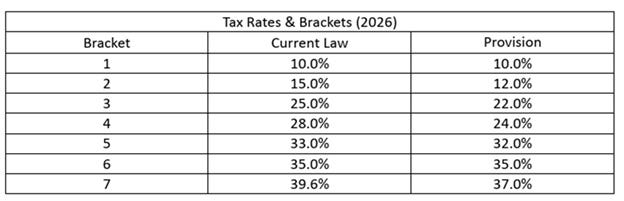

Section 1 is amended to lower the percent tax rate for bracketed earners by the following percentages:

For some perspective, a single filer makes up to $11,925 for bracket 1, and $626,350 or more for bracket 7, meaning the first guy will pay $1,192.50 in taxes (and save nothing), and the last guy will pay $231,749.50 and save $16,285.10 by this new amendment.

110002 - EXTENSION OF INCREASED STANDARD DEDUCTION AND TEMPORARY ENHANCEMENT

Section 63 is amended to increase the standard deduction to $24,000 for head of household, $16,000 for single filers, and $32,000 for married filing jointly.

110003 - TERMINATION OF DEDUCTION FOR PERSONAL EXEMPTIONS

Section 151 is amended to permanently repeal deductions for personal exemptions, which has not been in effect since 2018.

110004 - EXTENSION OF INCREASED CHILD TAX CREDIT AND TEMPORARY ENHANCEMENT

Dates in section 24 are extended, and the child tax credit of $2000 will be permanent.

110005 - EXTENSION OF DEDUCTION FOR QUALIFIED BUSINESS INCOME AND PERMANENT ENHANCEMENT

Section 199 is amended to increase the deductible amount of qualified business income or real estate investment from 20% to 23%.

110006 - EXTENSION OF INCREASED ESTATE AND GIFT TAX EXEMPTION AMOUNTS AND PERMANENT ENHANCEMENT

Section 2010 increases the lifetime gift tax exemption from $5 million to $15 million for single filers ($30 million filing jointly).

110007 - EXTENSION OF INCREASED ALTERNATIVE MINIMUM TAX EXEMPTION AND PHASE-OUT THRESHOLDS

Section 55 is amended to permanently increase the minimum exemption and phase-out thresholds (i.e. if you make below a certain amount you do not pay income tax).

110008 - EXTENSION OF LIMITATION ON DEDUCTION FOR QUALIFIED RESIDENCE OF INTEREST

Section 163 is amended to permanently lower the deduction for residence interest to $750,000.

110009 - EXTENSION OF LIMITATION ON CASUALTY LOSS DEDUCTION

Section 165 is amended to clarify that you can only itemize deductions for uncompensated personal casualty losses if there is a federally-declared disaster.

110010 - TERMINATION OF MISCELLANEOUS ITEMIZED DEDUCTION

Section 67 is amended to no longer include expenses like tax preparation, work-related travel, and uniforms in miscellaneous itemized deductions.

110011 - LIMITATION ON TAX BENEFIT OF ITEMIZED DEDUCTIONS

Section 68 is amended to reduce itemized deductions.

110012 - TERMINATION OF QUALIFIED BICYCLE COMMUTING REIMBURSEMENT EXCLUSIONS

Section 132 is amended to state that the $20/month employee bicycle expense reimbursement will now be taxable as income.

110013 - EXTENSION OF LIMITATION ON EXCLUSION AND DEDUCTION FOR MOVING EXPENSES

Section 217 is amended to remove deductions for moving expenses, except for active-duty members of the military.

110014 - EXTENSION OF LIMITATION ON WAGERING LOSSES

Section 165 is amended to state that any gambling deductions may not exceed winnings.

110015 - EXTENSION OF INCREASED LIMITATION ON CONTRIBUTIONS TO ABLE ACCOUNTS AND PERMANENT ENHANCEMENT

Section 529 is amended to permanently allow for additional contributions to Achieving a Better Life Experience (ABLE) accounts, a "tax-advantaged savings account for individuals with disabilities."

110016 - EXTENSIONS OF SAVERS CREDIT ALLOWED FOR ABLE CONTRIBUTIONS

Section 25B is amended to permanently allow beneficiaries of ABLE accounts to qualify for the Saver's Credit, a "federal tax credit that helps low- to moderate-income taxpayers save for retirement."

110017 - EXTENSION OF ROLLOVERS FROM QUALIFIED TUITION PROGRAMS TO ABLE ACCOUNTS PERMITTED

Section 529 is also amended so that beneficiaries of ABLE accounts can roll over their qualified tuition programs tax-free.

110018 - EXTENSION OF TREATMENT OF CERTAIN INDIVIDUALS PERFORMING SERVICES IN THE SINAI PENINSULA AND ENHANCEMENT TO INCLUDE ADDITIONAL AREAS

Section 11026 of Public Law 115-97 is amended to permanently include the Sinai Peninsula, Kenya, Mali, Burkina Faso, and Chad as "hazardous duty area" for tax purposes.

110019 - EXTENSION OF EXCLUSION FROM GROSS INCOME OF STUDENT LOANS DISCHARGED ON ACCOUNT OF DEATH OR DISABILITY

Section 108 is amended to permanently exclude any income resulting in discharge of student debt due to death or disability, but adds Social Security number requirements in order to claim the exclusion (i.e. if you don't have papers, you will be taxed; if you do, you won't).

If you would like to read the bill yourself, click the link below.

The Big, Beautiful Bill

Ellie is an author, editor, and owner of Red Pencil Transcripts, and works with filmmakers, podcasts, and journalists all over the world. She lives with her family just outside of New York City.

This section is provoking some thought from me, and this is because I probably haven't taken enough time as yet to synthesise (fully) what's going on here.

From my own personal experience of Federal income taxes over the past 43 years - and yes: I have done and filed my own taxes throughout this entire period (with a brief exception when I was living overseas and had a Corporate Employer who was doing 'tax equalisation' for me,) here are my initial thoughts:

What used to be afforded to us all in "Schedule A" of Form 1040 (the Federal Tax Return for individuals,) was a set of categories in which a comprehensive range of "itemised" deductions (from our income) was allowed.

And this section of the Federal return does still exist.

*However*

What is known as the "Standard Deduction" on Form 1040, has risen to a level (it's presently $16000 or thereabouts I think,) at which it is quite hard for the usual wage-earner ever to have itemized deductions in Schedule A that will exceed.

In addition, itemized deductions in Schedule A were already pretty seriously throttled in a number of its categories

Medical deductions for example, were only allowed for those in excess of some percentage of one's AGI (adjusted gross income.) I think that percentage might have been something like 7% of one's AGI. And this meant that a person would have to had been out of pocket for quite a serious amount of medical expenses in order to get any sort of Schedule A deduction.

A thing that many people will be much more aware of recently though, relates to deductions for mortgage interest and property taxes on one's home.

Initially there were caps on the largest allowable mortgage upon which income paid was deductible. That used to be $1M (which admittedly is a pretty big mortgage loan,) but nevertheless ...

More recently, *no such deductions* are allowed at *all* at present.

This is the infamous "SALT" (State and Local Taxes) area of previously allowed Sched A deductions that were completely discontinued.

So, before putting you all into a total coma here:

The punch line of this section seems to me to be:

"We're really not going to allow much of any benefit to people who are 'wage earners' at all!"

And yes: while they are lowering the income tax rates a little bit in each of the Federal tax earned income brackets, they are still largely going to be taking a good 20% to 25% off rather most people's income who live down at this [woeful] end of the money-making scale.

Hint:

Earned income is *not* the way that the truly wealthy in our society *add* to their wealth, or *protect* it from Federal 'income' taxation.

I will be happy to develop a short tutorial about how people with *wealth* (as opposed to *income*) go about all of this.

Thank you for simplifying the language of this bloated and intentionally misleading bill. HOWEVER—for most of us who read your substack what I need for each section is —what does this change, what does it mean for your average person and what, generally, is good or bad about this proposed section? What are the future implications? What is it going to “cost” us? Why would Heritage people think it is a good idea? Who does it harm, who does it help? Then we know how to fight back against it. Then we know what to demand if our congresspeople. For example, to hear that 16 million people will be kicked off Medicare is one fact (but your mind thinks—maybe they can get into another plan). But to be told—it also means that hundreds of rural hospitals will be forced to close—well that’s way more disturbing because it affects entire regions of states, both red and blue, and will have longer lasting detrimental effects—you can’t just start up a hospital after years of disuse, for example. We need CONTEXT!