H.R. 1 - The Big Beautiful Bill (Simplified) - Part 11.6 - Taxes - Immigrants and Fraud, Waste, and Abuse

It's long, it's complicated, and Marjorie Taylor Greene (and probably most people she works with) hasn't read it. Let's not be one of those people. Here is a simplified version of a very complex, and very dangerous bill, that's easy to read and something we can all understand. Please share with friends and family. Thank you.

TITLE XI -- COMMITTEE ON WAYS AND MEANS, "THE ONE, BIG, BEAUTIFUL BILL"

REMOVING TAXPAYER BENEFITS FOR ILLEGAL IMMIGRANTS

112101 - PERMITTING PREMIUM TAX CREDIT ONLY FOR CERTAIN INDIVIDUALS

Section 36 of the Internal Revenue Code of 1986 is amended to exclude from premium tax credits individuals who are "lawfully present" in the U.S. and change the terminology to "lawful permanent residents," which includes certain Cuban immigrants and people living in the U.S. through the Compact of Free Association, a relationship between the U.S. and Pacific Island sovereign states. This change will restrict low- and middle-income families from being eligible for health insurance under the Affordable Care Act (ACA).

112102 - CERTAIN ALIENS TREATED AS INELIGIBLE FOR PREMIUM TAX CREDIT

Section 36 is further amended to exclude from tax credits individuals who are "lawfully present" in the U.S., including those here due to asylum (political refugee), parole, temporary protected status (TPS) (foreign nationals unable to return due to unsafe conditions), deferred enforced departure (similar to TPS but under the President's discretion), and withholding of removal (U.S. agrees not to deport due to persecution based on race, religion, or politics). This change will prohibit the aforementioned individuals from using premium tax credits to purchase health insurance under the ACA.

112103 - DISALLOWING PREMIUM TAX CREDIT DURING PERIODS OF MEDICAID INELIGIBILITY DUE TO ALIEN STATUS

Section 42 of the Social Security Act of 1935 is amended to remove eligibility for anyone who is over the 100% federal poverty level from receiving Medicaid, as well as undocumented immigrants below the poverty level, and those currently in the 5-year Medicaid waiting period due to immigration status. This change will prohibit the aforementioned individuals from using premium tax credits to purchase health insurance under the ACA.

112104 - LIMITING MEDICARE COVERAGE OF CERTAIN INDIVIDUALS

Chapter 36 is further amended to exclude individuals who are "lawfully present" in the U.S. from Medicare eligibility, and include only those who are permanent residents.

112105 - EXCISE TAX ON REMITTANCE TRANSFERS

Chapter 36 is further amended to add an excise tax to payments sent back home by immigrants to their families. These will be upfront payments when money is wired to other countries from the U.S.

112106 - SOCIAL SECURITY NUMBER REQUIREMENTS FOR AMERICAN OPPORTUNITY AND LIFETIME LEARNING CREDITS

Section 25 is amended so that a student, taxpayer, or spouse must have a valid social security number or taxpayer identification number (TIN) in order to claim the American Opportunity Tax Credit (AOTC) ($2500 for college tuition, books, and fees) or Lifetime Learning Credit (LLC) ($2000 for college tuition, books, and fees). Undocumented immigrants, whether or not they pay taxes, will not be eligible for these credits.

PREVENTING FRAUD, WASTE, AND ABUSE

112201 - REQUIRING EXCHANGE VERIFICATION OF ELIGIBILITY FOR HEALTH PLAN

Section 36 is further amended to require yearly eligibility audits in order to enroll for coverage on the Health Exchange. This will inevitably delay financial assistance for applicants while they wait for eligibility confirmation every year, leading to loss of coverage.

112202 - DISALLOWING PREMIUM TAX CREDIT IN CASE OF CERTAIN COVERAGE ENROLLED IN DURING SPECIAL ENROLLMENT PERIOD

Section 36 is further amended to exclude anyone enrolling for Medicare or Medicaid during the Special Enrollment period (extended time outside the normal Open Enrollment period), which includes anyone with income below 150% of the federal poverty line, from receiving premium tax credits.

112203 - ELIMINATING LIMITATION ON RECAPTURE OF ADVANCE PAYMENT OF PREMIUM TAX CREDIT

Section 36 is further amended to remove the limit on excess premium tax credits an individual must pay if they misestimate projected yearly income, and requires them to reimburse the IRS for the full amount. Excess tax credits could be due to a change in income (new job, raise), changes in family size, or becoming eligible for health coverage through your work.

112204 - IMPLEMENTING ARTIFICIAL INTELLIGENCE TOOLS FOR PURPOSES OF REDUCING AND RECOUPING IMPROPER PAYMENTS UNDER MEDICARE

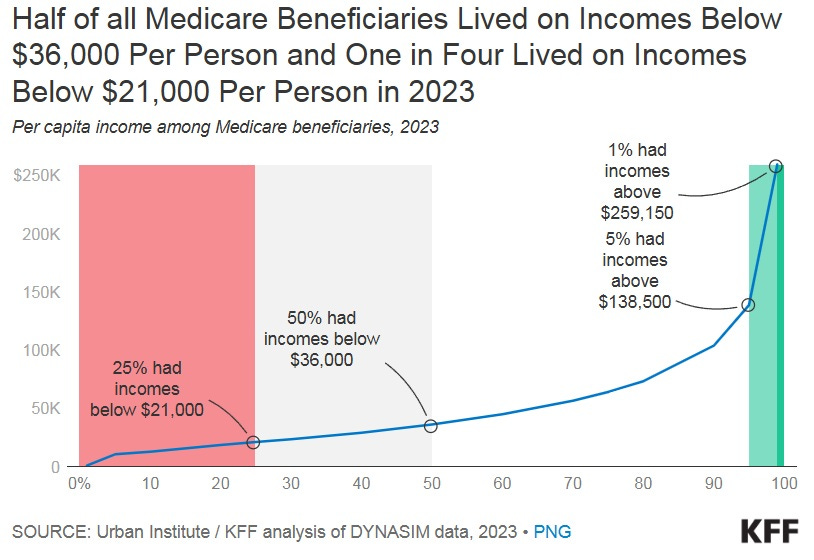

Section 42 of the Social Security Act of 1935 is further amended to give $25 million to the Secretary of Health and Human Services (currently Robert F. Kennedy Jr.) to work with Artificial Intelligence (AI) contractors to track down overpayments to individuals on Medicare, and require them to pay that amount back to the government. The average person on Medicare is 70.7 years-old. The average person on Medicare makes less than $36,000/year.

112205 - ENFORCEMENT PROVISIONS WITH RESPECT TO COVID-RELATED EMPLOYEE RETENTION CREDITS

This section raises the normal penalties for understatement of tax liability (declaring less income than you made) specifically for COVID-related Employee Retention Tax Credits (ERTC), which covered employees affected during the COVID-19 pandemic.

112206 - EARNED INCOME TAX CREDIT REFORMS

Chapter 77 is amended to put stricter standards in place when it comes to duplicate Earned Income Tax Credit claims (benefits low- to moderate-income families with children or other dependents). If a child is added, in error, twice, the IRS can withhold refunds and the Secretary of Treasury (currently Scott Bessent) has the ability to access the filer's payroll for verification of income as a means of hunting down fraud.

112207 - TASK FORCE ON TERMINATION OF DIRECT FILE

This section terminates the Direct File Program, which allows 25 participating states to file their taxes online for free, and will instead have the IRS and private sectors (certified public accountants (CPAs), agencies, and software like TurboTax and H&R Block) work together to provide free services. However, these "free" services (as most of us are aware) are only free up to a point and then charge anywhere from $60 to hundreds of dollars to file our taxes online.

112208 - POSTPONEMENT OF TAX DEADLINES FOR HOSTAGES AND INDIVIDUALS WRONGLY DETAINED ABROAD

This section aims to extend tax deadlines for those in combat, hostages, and those who are wrongfully detained. However, there is an automatic extension program already in place for those in active combat, and there is currently an automatic extension for hostages or those in a terroristic situation, and of course the latter is based on opinion and the courts, and thus may be biased as to who gets an extension and/or refund and who does not.

112209 - TERMINATION OF TAX-EXEMPT STATUS OF TERRORIST SUPPORTING ORGANIZATIONS

Currently the IRS can revoke recognition of a group's tax-exempt status after examination and period of time for appeal. However, according to this bill, the Secretary of Treasury (currently Scott Bessent) has the authority to declare any tax-exempt group a "terrorist organization" and remove its tax-exempt designation. This could put any churches, synagogues, food banks, and other charitable organizations at risk for helping migrant communities that are listed under broad, sweeping declarations.

112210 - INCREASE IN PENALTIES FOR UNAUTHORIZED DISCLOSURES OF TAXPAYER INFORMATION

This section serves to increase the fine for unauthorized disclosure of taxpayer information from $5,000 to $250,000, with a maximum imprisonment of 10 years. This is in clear contradiction to the activities behind closed doors at the Department of Government Efficiency (DOGE), where unqualified agents had access to all IRS data, putting taxpayer information at risk.

112211 - RESTRICTION ON REGULATION OF CONTINGENCY FEES WITH RESPECT TO TAX RETURNS, ETC.

Contingency fees (those charged by tax preparers with the assumption of monies gained after your return is accepted by the IRS) are highly discouraged because they can be used to maximize refunds, but often include fraudulent activities and abuse of funds. However, this bill states that the Treasury Department can no longer regulate, prohibit, or restrict the use of contingency fees when preparing tax returns.

113001 - MODIFICATION OF LIMITATION ON THE PUBLIC DEBT

The current debt limit ($36.1 trillion) was established on January 2, 2025 in the last days of the Biden Administration. This is the maximum amount of money the U.S. Treasury can borrow. The “Big Beautiful Bill,” however, provides that the U.S. Treasury can raise that debt limit by another $4 trillion.

If you would like to read the bill yourself, click the link below.

The Big, Beautiful Bill

Ellie is an author, editor, and owner of Red Pencil Transcripts, and works with filmmakers, podcasts, and journalists all over the world. She lives with her family just outside of New York City.

Yes it has been a complicated process. Senator Murkowski, put her self up for sale. America is not for sale by any means at all. No one has to run , at all life is life. If Senator Murkowski wants to change parties, I would not . Independent’s may not want you nor the democrats. Shame on you Madame Senator. I hope you can live with yourself.

Thanks again Ellie. This is so upsetting and it’s going to get worse.