It's long, it's complicated, and Marjorie Taylor Greene (and probably most people she works with) hasn't read it. Let's not be one of those people. Here is a simplified version of a very complex, and very dangerous bill, that's easy to read and something we can all understand. Please share with friends and family. Thank you.

TITLE IV – ENERGY AND COMMERCE

43101 - IDENTIFICATION AND AUCTION OF SPECTRUM

This section discusses the broadening of radio frequencies for federal and non-federal use, requiring not less than 600 megahertz of spectrum (full range of frequences and wavelengths of electromagnetic waves) for mobile broadband services. This will be auctioned off by the Federal Communications Commission (FCC) for licenses.

43201 - ARTIFICIAL INTELLIGENCE AND INFORMATION TECHNOLOGY MODERNIZATION INITIATIVE

As per the National Artificial Intelligence Initiative Act of 2020, the term "artificial intelligence" is defined as "a machine-based system that can, for a given set of human-defined objectives, make predictions, recommendations or decisions influencing real or virtual environments."

$500,000,000 will be appropriated for fiscal year 2025 to modernize federal information technology and deploy the use of artificial intelligence (AI) within the Department of Commerce. This includes replacing business systems and increasing efficiency and service delivery. No state or political subdivision may limit, restrict, or otherwise regulate any AI system or model entered into interstate commerce. This includes routing, zoning, procurement, or any procedure that facilitations the adoption of AI, and cannot impose civil liability, taxation, fees or other requirements on AI.

44101 - MORATORIUM ON IMPLEMENTATION OF RULE RELATING TO ELIGIBILITY AND ENROLLMENT IN MEDICARE SAVINGS PROGRAMS

The Secretary of Health and Human Services (HHS) (currently Robert F. Kennedy) cannot implement, administer, or enforce provisions of the final rule published by the Centers for Medicare and Medicaid Services in September 2023, which simplified the process for individuals to enroll and retain eligibility in Medicare Savings Programs (MSPs), through 2035.

44102 - MORATORIUM ON IMPLEMENTATION OF RULES RELATING TO ELIGIBILITY AND ENROLLEMENT FOR MEDICAID, CHIP, AND THE BASIC HEALTH PROGRAM

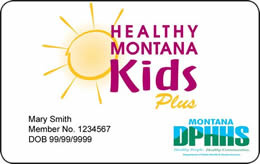

The Secretary of HHS cannot implement, administer, or enforce the provisions of the final rule published by the Centers for Medicare and Medicaid Services in April 2024, which simplified the enrollment process for Medicaid, the Children's Health Insurance Program (CHIP), and the Basic Health Program (BHP), and eliminated access barriers for children, through 2035.

44103 - ENSURING APPROPRIATE ADDRESS VERIFICATION UNDER THE MEDICAID AND CHIP PROGRAMS

Section 1902 of the Social Security Act is amended to add a process to "regularly obtain address information for individuals enrolled," and submit this information to the system "not less frequently than once each month" the social security number of each individual, and any other information "determined necessary" by the Secretary, so as to prevent enrolling in more than one state. $30,000,000 is allocated to create a system to prevent such multi-enrollments. Sources used for this system could include a forwarded address on a returned piece of mail, a Post Office change-of-address form, or a state health plan in another state. All State health plans that deliver care, inpatient or otherwise, must submit the home address of their patients to the State for verification. All the same actions will be taken with enrollees of the CHIP program.

44104 - MODIFYING CERTAIN STATE REQUIREMENTS FOR ENSURING DECEASED INDIVIDUALS DO NOT REMAIN ENROLLED

Section 1902 of the Social Security Act is further amended, adding quarterly screenings and reviews of the Death Master File (a database run by the Social Security Administration) to determine if enrolled individuals are deceased. If so, the individual would be disenrolled and all payments would stop. However, if an error occurs and an individual is labeled "dead" who is indeed alive, they will be re-enrolled. The State has the ability to use any data sources to identify potentially deceased beneficiaries, and nothing should stop them from doing so.

44105 - MEDICAID PROVIDER SCREENING REQUIREMENTS

Section 1902 of the Social Security Act is further amended to state that Medicaid providers must be screened on a monthly bases to determine whether the Secretary has terminated their participation under title XVIII (Health Insurance for the Aged and Disabled) or child health plan under title XXI (Supplemental Security Income for the Aged, Blind, and Disabled).

44106 - ADDITIONAL MEDICAID PROVIDER SCREENING REQUIREMENTS

Section 1902 of the Social Security Act is further amended to include quarterly screenings against the Death Master File to make sure a provider or supplier is not deceased.

44107 - REMOVING GOOD FAITH WAIVER FOR PAYMENT REDUCTION RELATED TO CERTAIN ERRONEOUS EXCESS PAYMENTS UNDER MEDICAID

Section 1903 of the Social Security Act is amended to remove the good faith option, which allowed states to demonstrate good faith efforts to manage their eligibility error rate, still giving them an allowance of federal funds.

44108 - INCREASING FREQUENCY OF ELIGIBILITY REDETERMINATIONS FOR CERTAIN INDIVIDUALS

Section 1902 of the Social Security Act is amended to require redetermination of eligibility every six months.

44109 - REVISING HOME EQUITY LIMIT FOR DETERMINING ELIGIBILITY FOR LONG-TERM CARE SERVICES UNDER THE MEDICAID PROGRAM

Section 1917 of the Social Security Act is amended to state that the prior maximum home equity interest limit of $1,097,000 required for long-term care eligibility, that grew annually based on inflation, will now cap out at $1,000,000 with no growth over time. There will no longer be exceptions for the elderly, blind, or disabled.

44110 - PROHIBITING FEDERAL FINANCIAL PARTICIPATION UNDER MEDICAID AND CHIP FOR INDIVIDUALS WITHOUT VERIFIED CITIZENSHIP, NATIONALITY, OR SATISFACTORY IMMIGRATION STATUS

Section 1903 of the Social Security Act is amended to state that no Medicaid or CHIP federal funds will be used toward individuals without "satisfactory immigrant status," for which they will be given 90 days to prove their position of legal residency. A state may choose to provide care during this timeframe, but federal funds will not be available until they can prove their status.

44111 - REDUCING EXPANSION FMAP FOR CERTAIN STATES PROVIDING PAYMENTS FOR HEALTHCARE FURNISHED TO CERTAIN INDIVIDUALS

Section 1905 of the Social Security Act is amended to change the Federal Medical Assistance Percentage (FMAP) from 90% to 80% for states that provide Medicaid coverage to undocumented immigrants.

44121 - MORATORIUM ON IMPLEMENTATION OF RULE RELATING TO STAFFING STANDARDS FOR LONG-TERM CARE FACILITIES UNDER THE MEDICARE AND MEDICAID PROGRAMS

The Secretary of HHS cannot implement, administer, or enforce the provisions of the final rule published by the Centers for Medicare & Medicaid, which established minimum staffing standards for long-term care facilities in order to ensure safe and quality care.

44122 - MODIFYING RETROACTIVE COVERAGE UNDER THE MEDICAID AND CHIP PROGRAMS

Section 1902 of the Social Security Act is amended to state that eligible applicants for Medicaid and Chip will no longer receive three-month retroactive coverage for care, but instead just one month.

44123 - ENSURING ACCURATE PAYMENTS TO PHARMACIES UNDER MEDICAID

Section 1927 of the Social Security Act is amended to require pharmacies to be transparent about acquisition costs, whether retail or non-retail, in order to determine a national cost benchmark (including discounts, rebates, and other price concessions) so as to establish more consistent Medicaid reimbursement rates. $13,000,000 will be appropriated to DHHS for periodic studies of survey data.

44124 - PREVENTING THE USE OF ABUSIVE SPREAD PRICING IN MEDICAID

Section 1927 of the Social Security Act is amended to state that there will be a contract between the State and pharmacy benefit managers (PBMs) that will allow for more oversight in order to prevent "abusive spread pricing" (when BPMs charge Medicaid more for the same drug), and require a "pass-through pricing model" which would limit what BPMs can charge for pharmaceuticals.

44125 - PROHIBITING FEDEARL MEDICAID AND CHIP FUNDING FOR GENDER TRANSITION PROCEDURES

Section 1903 of the Social Security Act is amended to disallow federal funding from Medicaid or CHIP to be used to cover gender-affirming hormone therapy and surgeries, and puberty blockers for minors. This includes a very long and specific list of surgeries, including cosmetic, meant to "feminize or masculinize the facial or other body features of an individual." However, puberty blockers can be prescribed to individuals experiencing precocious (early) puberty, and treatments can be prescribed for individuals born with both sexes.

44126 - FEDERAL PAYMENTS TO PROHIBITED ENTITIES

No federal funds under title XIX (Medicaid) can be used for "prohibited entities." This includes abortion providers, non-profit essential community providers that are engaged in family planning and reproductive health, and 501(c)(3) tax-exempt organizations.

44131 - SUNSETTING ELIGIBILITY FOR INCREASED FMAP FOR NEW EXPANSION STATES

Section 1905 of the Social Security Act is amended to state that the temporary 5% enhanced Federal Medical Assistance Percentage (FMAP) given to states under the American Rescue Plan Act will be rescinded.

44132 - MORATORIUM ON NEW OR INCREASED PROVIDER TAXES

Section 1903 of the Social Security Act is amended to freeze existing state provider tax rates in order to prevent increased rates with new providers.

44133 - REVISING PAYMENTS FOR CERTAIN STATE DIRECTED PAYMENTS

The Secretary of HHS will allow for upper payment limit increases for non-expansion states (those that have chosen not to expand their Medicaid programs to cover individuals with incomes up to 138% of the federal poverty level).

44134 - REQUIREMENTS REGARDING WAIVER OF UNIFORM TAX REQUIREMENT FOR MEDICAID PROVIDER TAX

Section 1903 of the Social Security Act is amended to prevent states from using non-uniform provider taxes (taxing healthcare providers in order to cover Medicaid fees) that would send costs back to the federal government.

44135 - REQUIRING BUDGET NEUTRALITY FOR MEDICAID DEMONSTRATION PROJECTS UNDER SECTION 1115

Section 1115 of the Social Security Act is amended to state that the Secretary may not approve an application of a Medicaid demonstration project, which allows states to try new approaches to providing Medicaid services, if it isn't fiscally responsible.

44141 - REQUIREMENT FOR STATES TO ESTABLISH MEDICAID COMMUNITY ENGAGEMENT REQUIREMENTS FOR CERTAIN INDIVIDUALS

Section 1902 of the Social Security Act is amended to state that all eligible applicants for assistance must show community engagement, including working 80 hours/month, being enrolled in school at least half-time, or has a monthly income not less than the minimum wage requirement. Exceptions include pregnancy or incarceration.

44142 - MODIFYING COST SHARING REQUIREMENTS FOR CERTAIN EXPANSION INDIVIDUALS UNDER THE MEDICAID PROGRAM

Section 1916 of the Social Security Act is amended to state that individuals making a certain percentage over the federal poverty line would be required to pay a portion of their medical costs. This cannot exceed 5% of the total family income.

44201 - ADDRESSING WASTE, FRAUD, AND ABUSE IN THE AFFORDABLE CARE ACT (ACA) EXCHANGES

Section 1311 of the Patient Protection and Affordable Care Act is amended to require more rigorous income verification, disallowing for self-attested income (to the best of your knowledge), which could be cross-checked with other government databases. It will also shorten the open enrollment period from 2.5 months to 1.5 months, beginning November 1st and ending December 15th. Special enrollment periods for those at 100% and higher of the Federal Poverty Level would be eliminated. Gender-affirming care procedures as an "essential health benefit" would also be eliminated.

44202 - FUNDING COST SHARING REDUCTION (CSR) PAYMENTS

Section 1402 of the Patient Protection and Affordable Care Act is amended to appropriate funds for reimbursement to private health plans that offer CSRs. CSR payments cannot be made to insurers offering plans to cover abortion services, except in cases of rape, incest, or to save a mother's life.

44301 - EXPANDING AND CLARIFYING THE EXCLUSION FOR ORPHAN DRUGS UNDER THE DRUG PRICE NEGOTIATION PROGRAM

Section 1192 of the Social Security Act is amended to expand the exclusion of orphan drugs (commercially undeveloped because it won't make the pharmaceutical companies much money) of single rare diseases from price negotiations, to drugs that treat more than one disease. These drugs need to be on the market longer and go through more research and development before prices can be negotiated.

44302 - STREAMLINED ENROLLMENT PROCESS FOR ELIGIBLE OUT-OF-STATE PROVIDERS UNDER MEDICAID AND CHIP

Section 1902 of the Social Security Act is amended to allow eligible out-of-State providers to enroll under the State Medicaid and CHIP plans, so as to streamline the process for pediatric patients who cross state lines for increased access to complex care.

44303 - DELAYING DSH REDUCTIONS

Section 1923 of the Social Security Act is amended to push back the intended Disproportionate Share Hospital (DSH) reductions (supplemental payments made to hospitals that treat more-than-the-normal amount of low-income patients who are often uninsured or covered by Medicaid) from 2026-2028 to 2029-2031.

44304 - MODIFYING UPDATE TO THE CONVERSATION FACTOR UNDER THE PHYSICIAN FEE SCHEDULE UNDER THE MEDICARE PROGRAM

Section 1848 of the Social Security Act is amended to change the Medicare Conversion Factor (CF) (determines how much providers are paid from Medicare payments) to better reflect increases in inflation and costs.

44305 - MODERNIZING AND ENSURING PHARMACY BENEFIT MANAGER (PBM) ACCOUNTABILITY

Section 1860 of the Social Security Act is amended to require transparency from PBMs via cost-performance evaluations, in order to prevent over-earnings from drug list prices, rather than bona fide service fees (i.e. they don't earn based on the rate of drug-cost increases, but the work they do behind the counter).

If you would like to read the bill yourself, click the link below.

The Big, Beautiful Bill

Ellie is an author, editor, and owner of Red Pencil Transcripts, and works with filmmakers, podcasts, and journalists all over the world. She lives with her family just outside of New York City.

This bill appears to reduce citizen benefits and increase the power of the Secretary of HHS to deny coverage or increase costs to patients.

Just Say No to this Big Betrayal Bill.

I hope this bill doesn't s t pass. I have three surgeries coming up n I cannot afford if I have to pay myself